In May, I bought $1,000 worth of crypto currencies. The market then plummetted. This turned many of my ‘investments’ to zero.

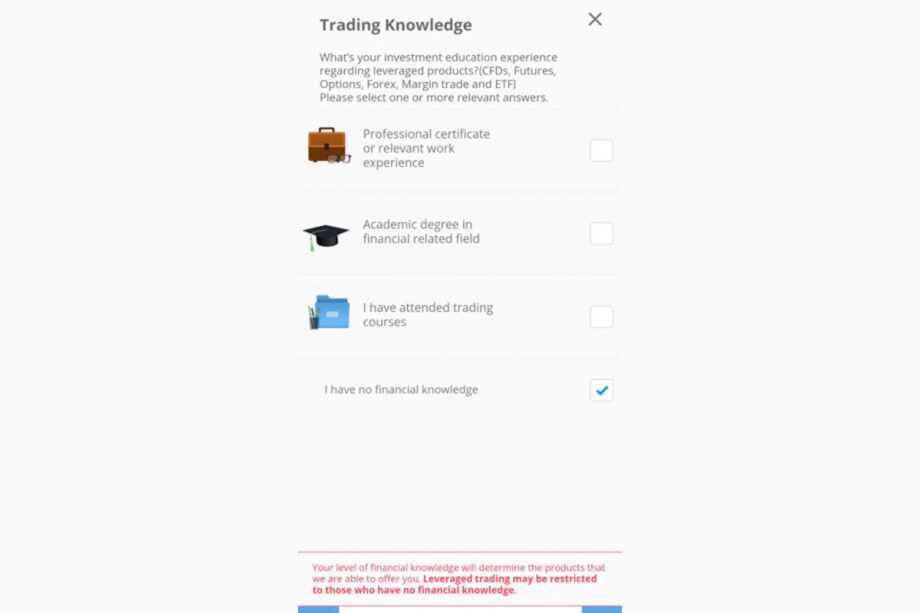

But what is a bad loser (not to mention: one who is so financially illiterate that even profit hungry investing apps won’t let him trade because he can’t pass their basic trading vocabulary tests) to do after getting their arse kicked? Buy more.

After most of my crypto ‘investments’ lost 50% of their value (in some cases worse, with many speculative “shit coins” zooming to $0 quicker than you can say “wen lambo”), I chucked a couple more hundred dollars at Bitcoin and Ethereum, as well as buying a couple of new ‘sustainable’ (or at least, less energy intensive) coins recommended by the first article which popped up on a Google search.

Watch Elon Musk and Mark Cuban talking about alternative uses for crypto currencies in the video below.

I then stopped looking at it, and focussed on living my life, rather than licking my wounds.

Then a remarkable thing happened. After being called an “idiot” by most of my friends and family, around the start of October (when I had basically written off my crypto experiment as a bad joke which – hopefully – made for a good PSA/warning article, but little else) a strange thing happened. Bitcoin, Cardano (one of those energy efficient new coins I had bought) and a dumb “meme coin” called Shiba Inu, which I had spent 3 months cursing as one of my worst picks, started pushing my wallet upwards.

What is this sorcery?

First, some context. In May I bought, in no particular order, Bitcoin, Dogecoin, Shiba Inu, Safemoon, AstroPup, AC Milan Fan Token, Revain, Ethereum and CumRocket. A mix of so-called legit and also completely speculative and stupid coins that happened to be trending at the time thanks to Reddit groupthink and hype trains.

This is what I wrote at the time (in June) for each one, after owning them all for a month (plus an update from today, October the 14th).

Bitcoin

What I wrote in June: “I bought $500 of Bitcoin on CoinSpot on the 11th of May thinking ‘here’s a safe bet.’ It turned out to be one of my worst performers. Shortly after I bought in, Elon Musk announced Tesla would no longer accept Bitcoin as payment (citing the environmental impact of mining), cracked some quips on a talk show (and China cracked down on Bitcoin mining), and now my investment is worth less than half what I put in ($180).”

October 14th update: Bitcoin has bounced back. All up I have put $845 into it (I bought another 300 or so after the experiment ended). It’s currently worth $1,129.

Dogecoin

What I wrote in June: “My $100 Dogecoin investment also tanked alongside Bitcoin after derogatory comments from Elon Musk on SNL went viral. It has recovered better than Bitcoin (alongside some reconciliatory comments from Musk), but I am still down overall. I’m also ashamed to say I don’t know exactly what my $100 is worth now because I threw a bit more money in after it went down, as the “degenerate” mindset, unfortunately, rubbed off on me. If this isn’t the equivalent of going back to the ATM after losing all your money at a Casino then I don’t know what is. And the doors never close…

October 14th update: Dogecoin has fluctuated wildly since then, at times bouncing back massively (it got to $900 at one point), at times dropping. Right now it’s worth $393. All up I have put $515 into it ($100 from the May experiment, $300 since then).

Shiba Inu

What I wrote in June: “I bought $100 of Shiba Inu at the latest big peak (soon after it was released). It has gone down, and I can’t tell you how much it is now worth because I have desperately thrown more bits and pieces (think, $30, $50) at it since the various dips. For those wondering what Shiba Inu is, it hopes to be the next Dogecoin and its anonymous founder (without asking) earlier this year sent 50% of Shiba Inu coins to Russian-Canadian Ethereum co-founder Vitalik Buterin (presumably in an attempt to garner publicity).”

“Buterin didn’t want the responsibility so burnt much of the wallet and donated the rest to charity. This caused a widespread sell-off. As Buterin said on the Lex Fridman podcast recently, though many users were angry they lost money, many others were glad to have been part of something that did good in the world. My reasoning for buying Shiba Inu was simple: I liked the sound of it maybe being the next Dogecoin (though I have no facts to back this up, and haven’t read any of its White Paper). That prophecy has yet to come true.”

October 14th update: from investing $460 into Shiba Inu, it’s now worth $1,213. Read more about what made it spike here. Who knows if it will drop back down again and be forgotten about, or continue. But for now I’m stoked.

Safemoon

What I wrote in June: “In true cult-like fashion, the only reason I bought SafeMoon (and the original impetus for this whole experiment) is because one of my housemates is obsessed with it, claiming to have made $2,000 overnight (and then pulling out before the major spike even happened).”

“On reflection, I doubt it has any real value whatsoever and I suspect its “charity project”, which came to my attention after I had already bought it, is just hot air to encourage gullible people to join the group. It’s probably just a Ponzi scheme/shit coin with a somewhat more sophisticated veneer than many of the others (though I could be wrong).”

“I also completely fell for the buzzword concept of ‘tokenomics’ in which this coin (like many others) claims to reward long term holders by taxing sellers and redistributing that money among holders. However, after having negative experiences with other coins which mimick SafeMoon’s model (see: Astro Pup) I have learned in any of these things you are utterly at the mercy of the developers.”

“Though the value of my SafeMoon hasn’t completely bottomed out like some of the other ‘shit coins’ I bought, my other bad experiences have rattled my faith. Still, I’m holding out hope for one more big spike before cashing out.

October 14th update: Still waiting on that major spike. I’ve put about $500 into it and it’s now worth $158. Yikes.

Astropup

What I wrote in June: “I’ll be honest: even though I hyped myself up and told myself (‘I’m not gambling anything I’m not happy to lose’) this one broke my heart. I scanned through the BscScan token transfer list (a list of all the coins currently being bought and sold), picked a random coin so new it didn’t even have an icon yet (as I was taught in the depths of Reddit), and congratulated myself on getting in early on a sure-fire winner…”

“I made sure it had a high market cap and that it wasn’t being held by one huge whale holder, and that it had a high turnover of transfers, and put about $50 in. I went to bed that night and woke up to find my money had tripled! Greed and a lack of technological prowess meant I decided to wait a little longer before cashing out. Wouldn’t you know: in the time it took for me to decide I should get him to help me cash out the entire value of the coin went basically to zero.”

“It was claimed on the coin’s Reddit page that one developer went rogue. Then, even in the wake of this scam, another scam – Astro Kitty – was promoted in this group’s ashes. It was also promised – as the price of Astro Pup was about halfway through plummeting – that users’ coins would be automatically re-instated, as part of the ‘good’ developers’ next project, to make up for the massive rug pull that had occurred by the ‘bad’ rogue developer, “Bobo.” This has yet to happen, and I assume it was simply a ploy to stop people from selling off so fast. It’s now pointless for me to sell as the transaction fee involved in selling (about $1.25) is higher than what my $50 is now worth.”

October 14th update: still worth absolutely nothing. What a scam. Can’t believe I fell for it.

Ethereum

What I wrote in June: “Ethereum tanked along with Bitcoin (and most of the crypto currency world) a couple of days after I put money in. I also put a bit more money in after it crashed in hope of making some of my losses back. It has now recovered a little.”

October 14th update: Like Bitcoin it’s bounced back. My $300 or so of Ethereum is now worth $515.

Cumrocket

What I wrote in June: “This is the most ridiculous sounding of my gambles. It also came recommended by another housemate. It is yet another ‘shit coin’ but one which claims to actually have a use case – CumRocket Crypto claims to present ‘a revolutionary take on the multi-billion pornography industry, aiming to decentralize it and make it rewarding for both creators and fans.’ It is the only one of my coins that has spiked significantly since I purchased it (due to Elon Musk tweeting about it). I was too greedy to cash out at the time though (as my ‘investment’ of $14 odd dollars spiked to $40) and when it started going down again I decided I had so little in there I may as well write this cycle off and hold out hope for another spike.”

October 14th update: It’s now worth $38 (I’ve probably put about $200 into it in total). I definitely should have cashed out when I had the chance. Putting more money in after the experiment has proved to be a poor move. Maybe if Elon Musk accidentally posts a dic pic the price will come back up…

Cardano

Not part of the original experiment. I bought about $220 in June/July.

October 14th update: It’s now worth $270.

Chainlink

I’ve bought about $70 in total ($10 in May, $50 in June).

October 14th update: It’s now worth $100.

Other coins

I spent maybe $300 ($50 or so on each one) on a bunch of other speculative shit coins that I took too long to cash out on and are now worth practically nothing. These include MoonPirate, Space Corgi, HappyCoin, HyperMeteor, Moonjuice and Saturna. Most of them are worth less than a dollar now. Ouch.

Final Reflections

All up I’ve made about $1,000 from Shiba Inu, Ethereum, Bitcoin, Cardano and Chainlink, and lost about $800 on stupid meme coins (and other coins that looked legit, or were legit, and just haven’t performed that well). I’ve also got a bunch more which are about the same value I bought them for. I’m not exactly laughing my way to the bank, but at least the wins I’ve had in the last couple of months have made up for my losses, putting me, on balance, about exactly back to where I started.

This just goes to show why you should never invest more than you can afford to lose – I’ve learned (in my experience anyway) to get the wins you have to sustain a lot of losses, invariably counteracting your profits if and when you do pick a winner. So really, at this stage, I still see crypto as essentially gambling – something to do with disposable income you don’t want back, rather than investing.

That being said, good work is being done in the industry, and it does look to be growing up, with crypto ETFs now looking like maybe becoming a ~thing~ and there are undoubtedly some coins with real use cases (the trick is knowing what they are).

This is NOT financial advice. As I have demonstrated I know worse than nothing about investing. However, for what it’s worth, for now I will be holding onto my Bitcoin, Ethereum, Chainlink and Cardano investments (as well as Shiba Inu and Dogecoin out of sheer FOMO).

When it comes to meme coins like Shiba Inu and Dogecoin I have to admit I will be very temped to cash out as soon as there is a big spike – mainly because you never know when people will lose interest in one meme coin and move onto the next. I also know nothing about Chainlink and Cardano other than the fact they were recommended by a Google search, so don’t take my word for it and do your own research if you are interested in them. As for Bitcoin and Ethereum, I’m keeping them simply because they are the big guns/big names.

What the experts have to say

DMARGE spoke to James Whelan – Investment Manager at VFS Group in Sydney – on Thursday the 14th of October. Mr Whelan told DMARGE: “I think that the investment community is now seeing that there needs to be an allocation to a certain amount of crypto because people are seeing it as an alternative asset and potentially, touch wood, god forbid, a store of wealth.”

“Look at the Bitcoin price vs the Gold price – annoyingly – inflation is absolutely pumping [so] why is gold not performing? Look at the Bitcoin price – potentially people are buying Bitcoin instead of Gold as that store of wealth against inflation… Maybe.”

The idea being? People want Gold and Bitcoin as well, with the theory being they will (hopefully) act as buffers against inflation.

Mr Whelan added: “Right now all eyes are on the SEC in the United States on their approval of the first crypto ETF (or the first bitcoin ETF), which will then mean that people will have a place [to invest]. Once it’s done and accredited by the SEC it falls under all of their rules about financial stability and it has all these boxes it needs to tick and it comes under the coverage of one of the largest markets in the world and one of the better regulators in one of the largest markets in the world.”

Freshly updated look at Bitcoin Futures ETF Race including the first poss date each could launch (aka when the 75 days are up). If no issues, ProShares likely trading next wk. Their btc mutual fd launched 77 days after filing. That said still leaving 25% chance SEC pulls a Lucy. https://t.co/DmmKZNtOxK

— Eric Balchunas (@EricBalchunas) October 13, 2021

“If the SEC lets this [happen] it means the ETF will be approved, which then means people like me actually have somewhere to invest safely on the market on the same platform where everyone else can see all this stuff.”

“The investment community will have a more safe and secure place to actually have that area where I can say to a client on their portfolio report: ‘Look at this, as discussed, here is your 5% allocation to a Bitcoin ETF. It’s run by a reputable ETF provider, it’s on a market which is where all your other stuff is as well.’ That’s so important for a client to see.”

The rest of crypto still remains a bit of a Wild West, however. So when it comes to ‘meme coins’ (or even legit-looking coins that claim to have a use case but which you really don’t know anything solid about) however, be warned you are playing with fire (remember: there is a big difference between the Bitcoin ETF Mr Whelan is talking about the SEC looking into above and my ‘shit coin’ experimentation on Trust Wallet via Pancake swap…).

On that note: DMARGE sought comment from Vanguard Australia earlier this year (around May/June) regarding my $1,000 crypto experiment and recieved the following statement in response.

“We do urge caution against speculating in Bitcoin and other cryptocurrencies, which are largely unregulated and accompanied by a number of considerable risks including the potential loss of investment entirely in some instances.”

We were also pointed to an article in the Australian Financial review, featuring a quote from Vanguard Australia’s Balaji Gopal.

“A long-term portfolio should be comprised of stocks, bonds and cash,” Balaji Gopal, head of Vanguard Australia’s Personal Investor platform, told The Australian Financial Review. “We are quite happy to sit this one [cryptocurrency ETF] out, and we urge investors to be very wary of the risks of cryptocurrencies.”

Bitcoin and other cryptocurrencies fall short of Vanguard’s house definition for an asset class, commodity or even currency, Mr Gopal said, because they do not generate income or cash flow. Nor are they a store of wealth, unit of account or medium of exchange, he added, rejecting popular conceptions.

“Cryptocurrencies defy any kind of categorisation,” he said. “Their characteristics are more similar to collectables like fine art, exotic cars or baseball cards.”

It should be noted all this commentary was made before this week’s news that a Bitcoin ETF is being looked at by the SEC.

Expert’s advice for individual crypto ‘experimenters’

When asked about the most common mistakes rookie traders make, Josh Gilbert, market analyst at eToro, told DMARGE: “Rookie mistakes are common in any market that aims to empower the everyday investor.”

Some mistakes to avoid, he told DMARGE, include:

- Lack of understanding: Investors should ensure they’ve done their research and understand the asset they’re investing in, before deploying any capital.

- Emotional investing: While the crypto market is one that invokes a lot of passion, it’s important that rookie investors keep their emotions at bay and take a calculated approach when investing. Crypto markets can be volatile, so it’s important to maintain a level head, regardless of whether the market is experiencing a bull or bear run. Neither overconfidence nor FUD (fear, uncertainty, doubt) should motivate your investments.

- Hype-investing: The fear of missing out (FOMO) has led many investors down the road to disaster. Investors might seem tempted to jump into a cryptoasset that’s skyrocketing, but it’s important to understand the function of the asset. I highly recommend reading whitepapers associated with projects before investing.

- Putting your eggs in one basket: Diversification is the aim of the game. Instead of putting all their money into one cryptoasset, investors can hedge against risks by investing in multiple assets, lessening the blow if a coin unexpectedly drops in value. Smart investors instead diversify their crypto portfolios with a range of different assets and products.

Josh also busted a few quick myths about the sector, telling DMARGE this notion that crypto is a get-rich-quick scheme is flawed.

“Yes, investors can make some significant cash from crypto, but all in all, it should not be used as a main income. Like traditional stocks, crypto is very volatile, which means that smart investors should adopt responsible investing principles when dipping their toes into the crypto pool, and only invest what they can afford to lose.”

Read Next

- I Bought $1,000 Worth Of Cryptocurrency. It Was A Huge Mistake

- ‘Costly’ Crypto Tax Mistake Catching Australian Crypto Investors Unaware

The post I Made Over A Thousand Dollars On Cryptocurrency. I Still Don’t Know What The Hell I’m Doing appeared first on DMARGE.

from DMARGE https://ift.tt/3DBUQl2

0 comments:

Post a Comment